Sponsoring a 401(k) plan offers numerous benefits for business owners. Three key advantages are attracting & retaining talent, employer tax benefits and the ability to maximize your own contributions.

But, there is one caveat to maximizing your contributions…

In order for a business owner to reach the IRS maximum limit ($69,000; $76,500 for people 50 and above in 2024) they will need to establish what’s called a 401(k) “Safe Harbor” plan.

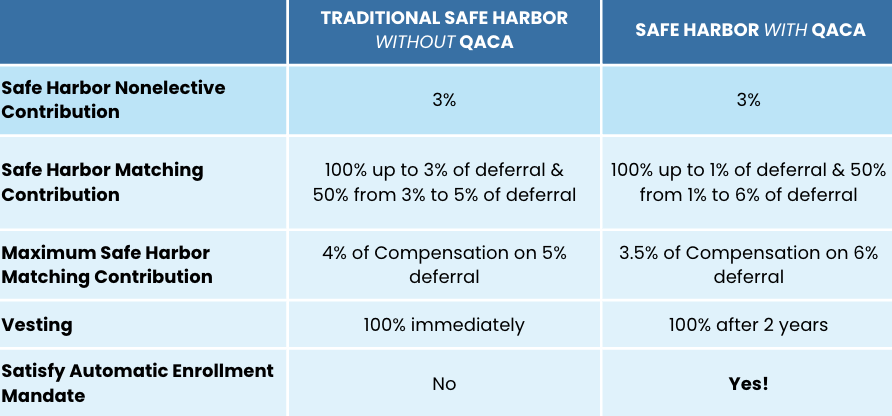

There are two types of Safe Harbor Plans: Traditional Safe Harbor and Qualified Automatic Contribution Arrangement (QACA) Safe Harbor. They both can either offer an employer matching contribution or a 3% nonelective contribution.

See the chart below to compare the key features of each.

Just like this summer heat, the deadline for implementing a Safe Harbor Plan for the 2024 Plan Year is coming in hot! Plan Sponsors must have the plan up and ready to accept contributions by October 1, 2024.

Don’t let Safe Harbor deadlines catch you in a summer daze! At My Benefits, we recognize the importance of optimizing retirement plans to align with your business owner clients’ goals. Leverage our expertise and personalized approach to make the implementation of a 401(k) Safe Harbor plan as smooth as possible.

Contact us today if your business owner clients are ready to implement or convert to a Safe Harbor 401(k) plan!

P.S. Thanks to SECURE 2.0, you can now convert your SIMPLE Plan into a 401(k) Safe Harbor Plan mid-year! Check out our blog for more details.

Your retirement plan questions answered, in plain English, by an expert. Use the form below to ask our retirement plan experts your question.