According to Fidelity Investment’s 2023 Small Business Retirement Index, only 34% of small businesses are currently offering retirement savings to employees and 21% don’t know how to start the process of offering a retirement plan, or which retirement plan vehicle works best for them.

Small business owners are faced with many challenges as they grow their business, therefore, being tasked with knowing the differences between a SEP IRA, SIMPLE IRA, and 401(k) can be intimidating.

To offer some color around a few common plan types let’s dive into the differences between a SEP IRA, SIMPLE IRA, and 401(k)!

A Simplified Employee Pension Plan (SEP) is primarily designed for self-employed individuals and small business owners who want to save for retirement without getting involved in complex plan administration. If you are self-employed, have a side gig, or have few employees, and want flexibility in the amount you contribute annually—particularly if you want to make high contributions—a SEP IRA might be right for you.

One caveat to implementing a SEP IRA is that contributions are made solely by the employer, meaning no employee contributions, offering a straightforward approach to retirement savings.

The Savings Incentive Match Plan for Employees (SIMPLE) strikes a balance between simplicity and affordability, making it an attractive option for businesses with fewer than 100 employees.

Unlike the SEP IRA, both employers and employees can contribute to a SIMPLE IRA, fostering a sense of shared responsibility for retirement savings. Another difference is that the contribution limits are lower than those in a SEP IRA —$16,000 plus an additional $3,500 “catch-up” contribution for individuals aged 50 and above in 2024.

Now, let’s dive into the most common design which is 401(k). A 401(k) plan is a versatile retirement savings vehicle known for its comprehensive features and potential for robust plan design.

Traditional 401(k)s allow for both employer and employee contributions, with elective deferrals of up to $23,000 for employees under 50 years old (2024 IRS limit), along with additional catch-up of $7,500 for a total of $30,500 in deferrals for those 50 and older. Furthermore, 401(k) plans offer diverse investment options, including stocks, bonds, and mutual funds, empowering participants to tailor their portfolios to their risk tolerance and financial goals.

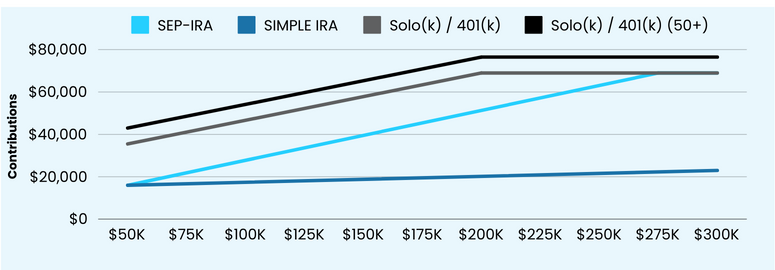

The graph below illustrates maximum contributions to the three retirement plan options by income level. As you can see, at every income level, the Solo 401(k) and 401(k) Profit Sharing Plans allow plan participants to contribute more towards retirement than the two other retirement plans.

As you can see, Solo(k)s and traditional 401(k)s not only offer higher contribution limits, but also offer more flexibility in design to manage business costs, taxes, and enable penalty-free access to funds via a loan if an emergency arises. Contact us today to discuss which plan design may best suit the needs of your business owner clients!

Have no fear, thanks to SECURE 2.0 businesses now have the option to transition from a SIMPLE IRA to a Safe Harbor 401(k) plan mid-year!

This transition unlocks a host of benefits and opportunities such as: enhanced contribution flexibility, simplified compliance through automatic non-discrimination testing satisfaction, and the ability to attract and retain top talent with a robust retirement benefits package. See our previous SIMPLE to 401(k) blog for more information!

As retirement plan experts, we at My Benefits are committed to supporting our financial advisor partners and are happy to help guide businesses through this decision-making process, offering tailored solutions and personalized support every step of the way.

Contact us today to explore which retirement plan vehicle might be best suitable for your business owner clients so we can ‘Bring it all together for you’.

Your retirement plan questions answered, in plain English, by an expert. Use the form below to ask our retirement plan experts your question.